From 1 October 2026, the UK Government will introduce a major new regulation that will increase the cost of all e-liquids, including nicotine-free liquids. This new rule is part of the nationwide Vaping Products Duty, which aims to standardise vaping taxation across the country.

Below, we break down exactly what’s changing, how much prices will rise, and what customers can do now to prepare.

🔍 What Is the New Vaping Duty?

From 1 October 2026, a tax of 22 pence + VAT will apply to every millilitre of e-liquid sold in the UK.

This applies to:

-

Nicotine e-liquids

-

Nicotine-free e-liquids

-

Shortfills

-

Nic salts

-

Prefilled pod liquids

-

Disposable device liquid volumes

This means *every vaping product containing liquid will see a significant price increase.

💸 How Much Will Prices Increase?

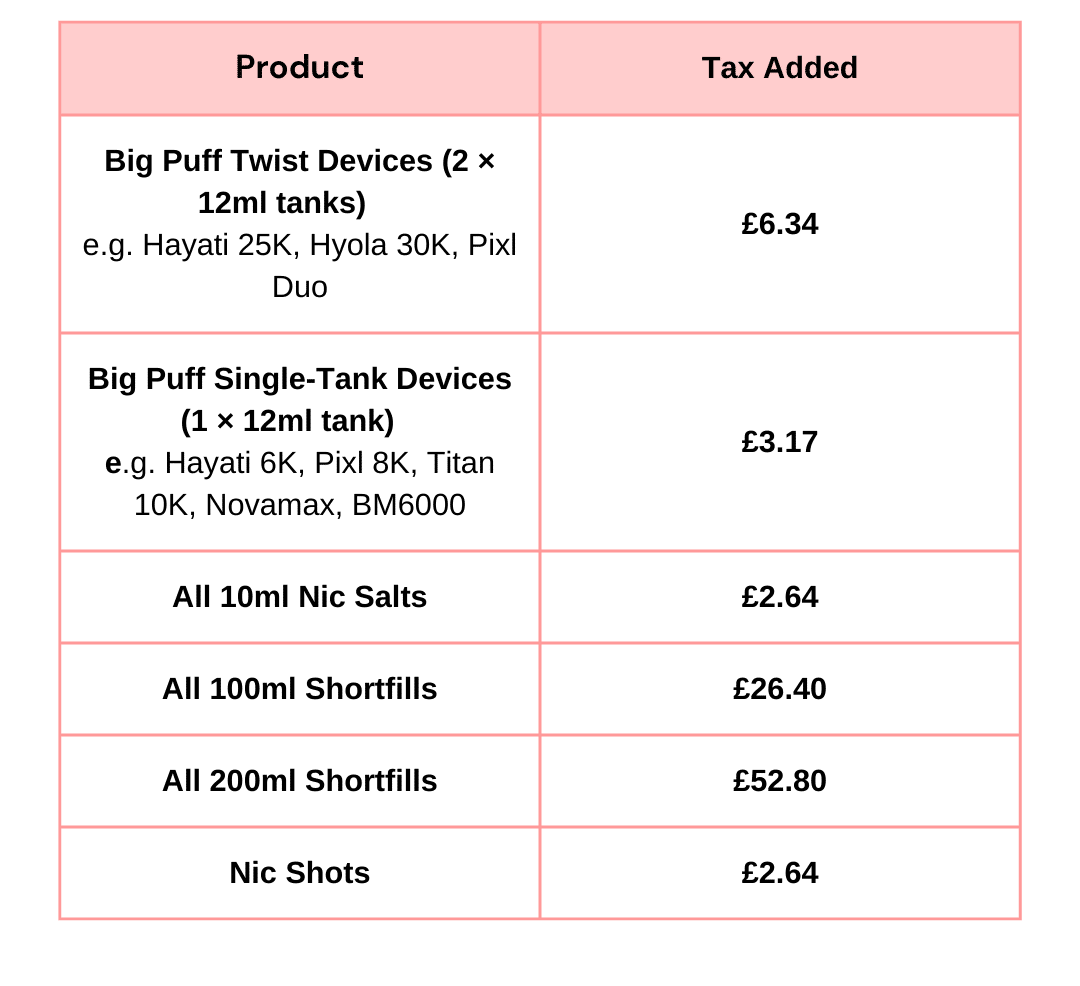

Here’s what the new vape tax looks like in real numbers:

Per Bottle Increases

-

10ml Nic Salts: + £2.64 per bottle

-

100ml Shortfills: + £26.40 per bottle

-

200ml Shortfills: + £52.80 per bottle

-

Nic Shots (10ml): + £2.64

These increases are tax only — not including manufacturing or retail markups.

📦 How the New Tax Affects Popular Devices

Many popular devices contain large amounts of liquid, which means the tax impact will be very noticeable.

The larger the liquid volume, the higher the tax.

⚠️ Will 100ml & 200ml Shortfills Be Discontinued?

Unfortunately, many manufacturers are already suggesting that large-size shortfills may not be viable after the 2026 tax comes in.

Why?

A tax increase of £26–£52 per bottle significantly raises the final retail price, making these bottles less appealing to consumers — and more costly to produce.

This could result in:

-

100ml shortfills becoming rare, or

-

200ml shortfills being discontinued entirely

If you rely on these sizes, it’s worth stocking up while they’re still available.

🛒 Why You Should Stock Up Now

Shortfills have a long shelf life — DIY E-Liquids 100ml Shortfills come with up to 4 years expiry — making it safe and cost-effective to buy in bulk now.

Current Offers (Before the Tax Arrives)

These offers provide excellent value before the new duty increases bottle prices by 800–1000%.

📈 Ingredient Price Increases Are Also Expected

As the 2026 duty approaches, manufacturers are forecasting higher demand for shortfills.

This increased demand may push up the cost of raw ingredients such as:

-

VG (Vegetable Glycerine)

-

PG (Propylene Glycol)

-

Flavour concentrates

This means prices may begin rising months before the new regulation officially begins.

Buying early protects you from:

-

Rising ingredient costs

-

Shrinking availability

-

Manufacturer discontinuations

🔥 Nic Salt Users: Your Deal Changes Too

Our popular 5 for £10 Nic Salts bundle will also be affected.

Under the new tax, the tax alone on this bundle will be £13.20 — more than the cost of the deal itself.

Stocking up on nic salts now is the most cost-efficient option.

📚 Want to Learn More?

Read the official government guide on vaping regulation changes here:

Preparing for Vaping Products Duty and the Vaping Duty Stamps Scheme — UK Government

💬 Final Thoughts: Stay Informed, Stay Prepared

The 2026 Vaping Duty is a significant change for the UK vaping market. Prices will rise across all brands and all liquids, but understanding the changes early allows customers to make smart decisions.

At DIY e-Liquids, we’re committed to:

-

Keeping prices fair

-

Offering the best deals while stock lasts

-

Providing transparent updates as the regulation date approaches

If you have any questions about how this affects your products, our team is always here to help.